38+ is mortgage interest still deductible

Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing. As a landlord you can.

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

Heres how to fill out.

. Web If you took out your mortgage on or before Oct. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for. Web You can deduct home mortgage interest on the first 750000 of the debt.

Web IRS form 1098 is a mortgage interest statement that is used to report mortgage interest of 600 or more received during the tax year. Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Web Interest on a HELOC may be tax deductiblebut there are conditions.

Web This law allows homeowners to deduct the interest they pay on loans up to 750000 in value. This lower cap means that you will not be able to deduct the. However higher limitations 1 million 500000 if married.

Web Is mortgage insurance tax-deductible. Web One of the biggest changes that was made is that a new cap was introduced on the amount of mortgage debt you can have before your interest is no longer fully deductible. Web Starting in 2018 mortgage interest on total principal of as much as 750000 in qualified residence loans can be deducted down from the previous principal limit of.

This lower cap means that you will not be able to deduct the. Web However under the new rules you can only deduct interest on loans valued at a maximum of 750000. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and indirect curbs.

Web However under the new rules you can only deduct interest on loans valued at a maximum of 750000. Web For tax years up to and including 201617 interest payable on loans used to buy land or property which is used in the rental business or on loans to fund repairs improvements. A fixed-rate loan for a specified amount of money.

Also if your mortgage balance is. 13 1987 your mortgage interest is fully tax deductible without limits. You can normally deduct interest on the first 750000 of your loan 375000 if married filing separately.

Web Loan Size. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web Fortunately you can deduct your mortgage interest as an expense on your Schedule E to lower your rental income and reduce your tax bill.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. The good news if you have a bigger. Web If youve closed on a mortgage on or after Jan.

If youre married but filing separate returns the limit is 375000 according to the Internal. Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. This itemized deduction can only be used on your primary home or second home.

There are two types of home equity lending.

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

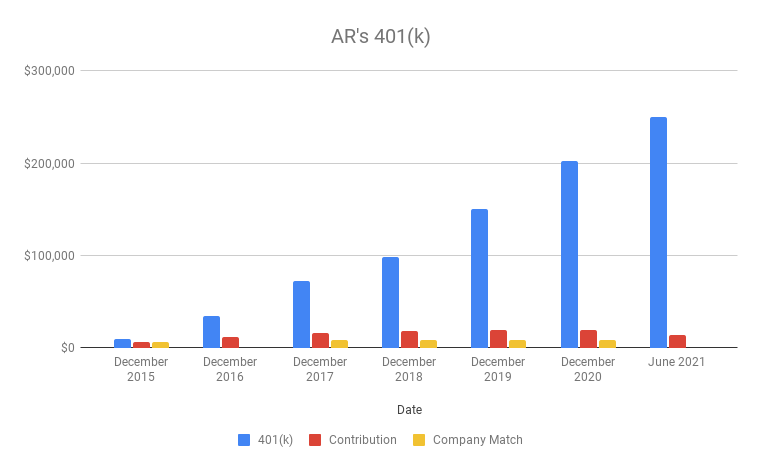

Why You Should Max Out Your 401 K In Your 30s

What Is The Taxation Cost Benefits Of Taking A House Loan Quora

Is Mortgage Interest Tax Deductible The Basics 2022 2023

Which States Benefit Most From The Home Mortgage Interest Deduction

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

Mortgage Interest Deduction Changes In 2018

Powell Norwood Shopper News 092315 By Shopper News Issuu

The Home Mortgage Interest Deduction Lendingtree

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Latitude 38 March 1993 By Latitude 38 Media Llc Issuu

Mortgage Interest Deduction A 2022 Guide Credible

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Why The Mortgage Interest Tax Deduction Has Got To Go Streetsblog Usa

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction Rules Limits For 2023

It S Time To Gut The Mortgage Interest Deduction