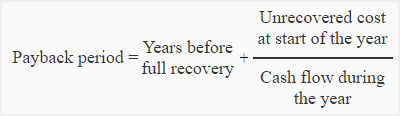

Simple payback period formula

How to calculate using the payback period formula. Payback Period p - np.

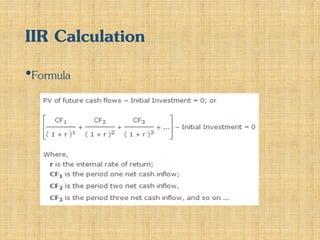

Payback Timevalue Of Money And Iir

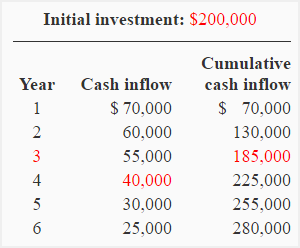

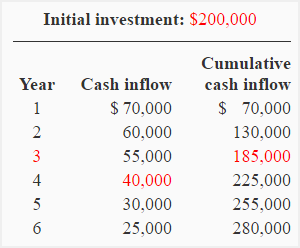

For example if a company invests 300000 in a new production line and the production line then produces positive cash flow of 100000 per year then the payback period.

. To calculate using the payback period formula you can divide the initial cost of a project or investment by the amount. Payback Period Initial Investment Annual Payback. The formula for discounted payback period is.

Discounted Payback Period Year before the discounted payback period occurs Cumulative cash flow in year before recovery Discounted cash flow in year after recovery 2. Now you might be wondering how to calculate payback period. The payback period calculation is simple.

Cash flow per year. However the discounted payback period would look at each of those 1000. Heres the payback period formula.

Find Cash Flow in Next Year. Investment amount discount rate. The simple payback period formula would be 5 years the initial investment divided by the cash flow each period.

The simple payback period formula is calculated by dividing the cost of the project or investment by its annual cash inflows. It can also be calculated using the formula. Payback Period Amount to be InvestedEstimated Annual Net Cash Flow.

Discounted Payback Period. Number of months 3193 819612 around 5 months. Calculate Net Cash Flow.

We will need the following number of months from the last period to break even. For example imagine a company invests 200000 in new manufacturing equipment which results in a positive cash flow of 50000 per. Retrieve Last Negative Cash Flow.

Investment Annual Net Cash Flow From Asset It can get a bit tricky when annual net cash flow is expected to vary from year to year. Payback period the cost of your investment average annual cash flow. Input Data in Excel.

- ln 1 -. To calculate a more exact payback period. Ln 1 discount rate The following is an example.

As you can see using this payback period calculator you a. The payback period is the total investment required to purchase the asset or fund the project divided by the net annual cash flow which is. The discounted payback period is.

The payback formula is simple.

Advantages And Disadvantages Of Bank Overdraft Accounting Books Financial Strategies Accounting And Finance

Find Break Even Point Volume In 5 Steps From Costs And Revenues Analysis Graphing Good Essay

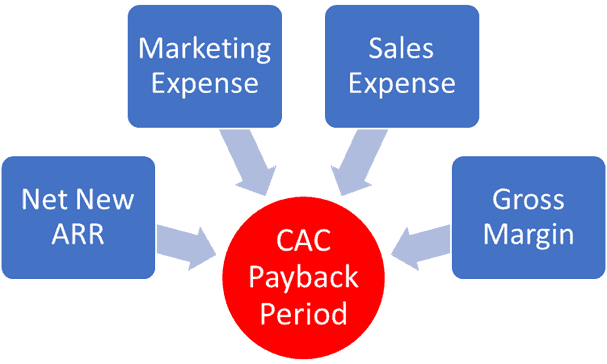

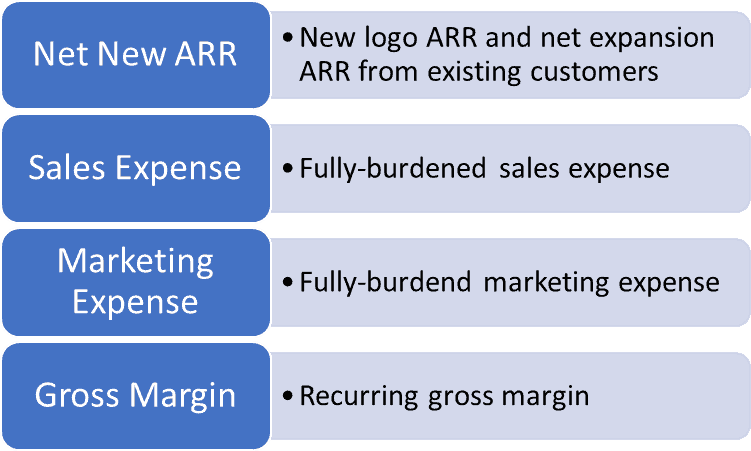

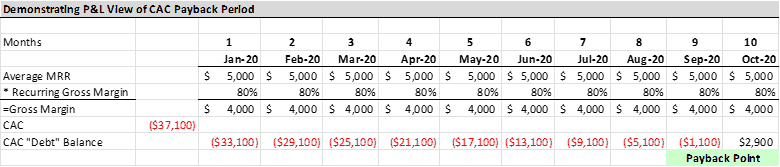

How To Calculate Your Overall Cac Payback Period The Saas Cfo

Pin On How To Get What You Want

/dotdash_Final_An_Introduction_to_Capital_Budgeting_Sep_2020-01-e2feb6a3d3a74e3abd4d2da585c9ef20.jpg)

An Introduction To Capital Budgeting

Payback Period Analysis Eme 460 Geo Resources Evaluation And Investment Analysis

How To Calculate Your Overall Cac Payback Period The Saas Cfo

Payback Method Formula Example Explanation Advantages Disadvantages Accounting For Management

A Beginner S Guide To Vertical Analysis In 2022 Financial Analysis Analysis Income Statement

Payback Method Formula Example Explanation Advantages Disadvantages Accounting For Management

Payback Period Method Example Youtube

Cash Sweep Optional Debt Prepayment Modeling

Payback Period Method Example Youtube

How To Calculate Your Overall Cac Payback Period The Saas Cfo

Payback Period Analysis Eme 460 Geo Resources Evaluation And Investment Analysis

Creditor Payables Days Tutor2u Business Financial Ratio Small Business Tools Resume

Roi Spreadsheet Example Spreadsheet Template Spreadsheet Excel Templates